The Index strategy is based on qualitative and quantitative inputs including economic data and interpretations of government policy. Asset allocation guardrails include 50% – 200% allocation relative to the benchmark for credit, duration, and structure/mortgage weight. A high conviction exposure to more speculative or diversifying positions is constrained to 0% – 20%.

The characteristics below reflect how we would best position a portfolio of fixed-income ETFs to achieve maximum total return over a comparable baseline neutral portfolio of fixed-income securities (benchmark).

Relative Positioning

Duration

90% Duration

Yield Curve

Neutral

Corporate Credit

Underweight

Securitized

Underweight MBS

Conviction

20% 0-5 US TIPS

Rationale

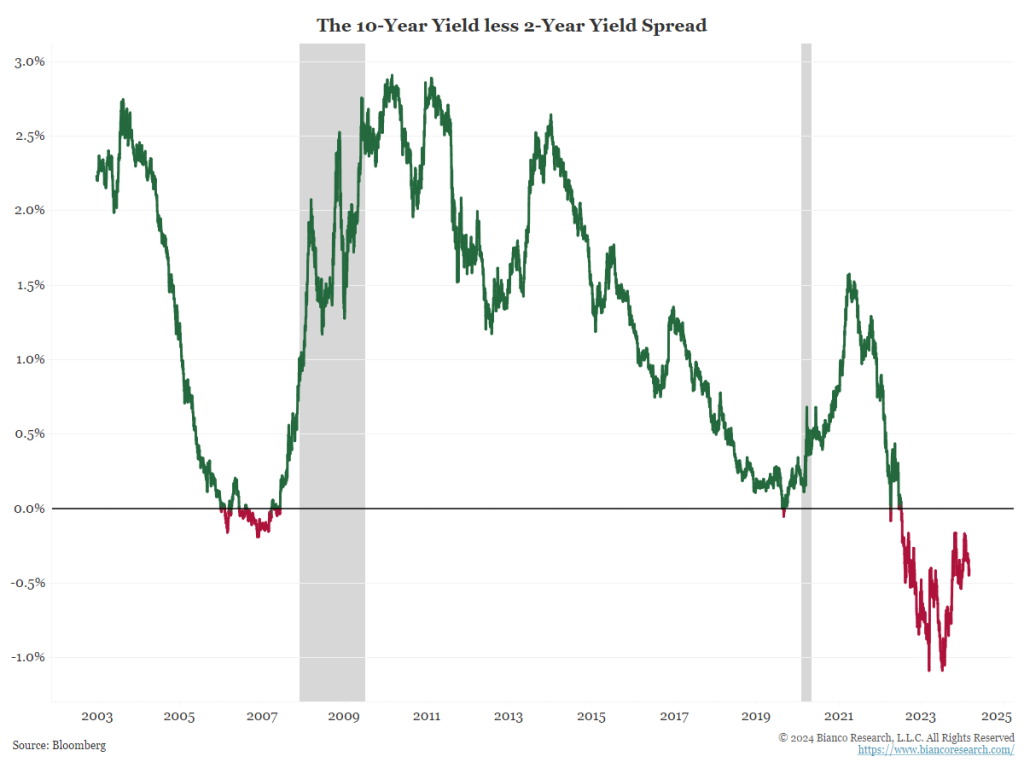

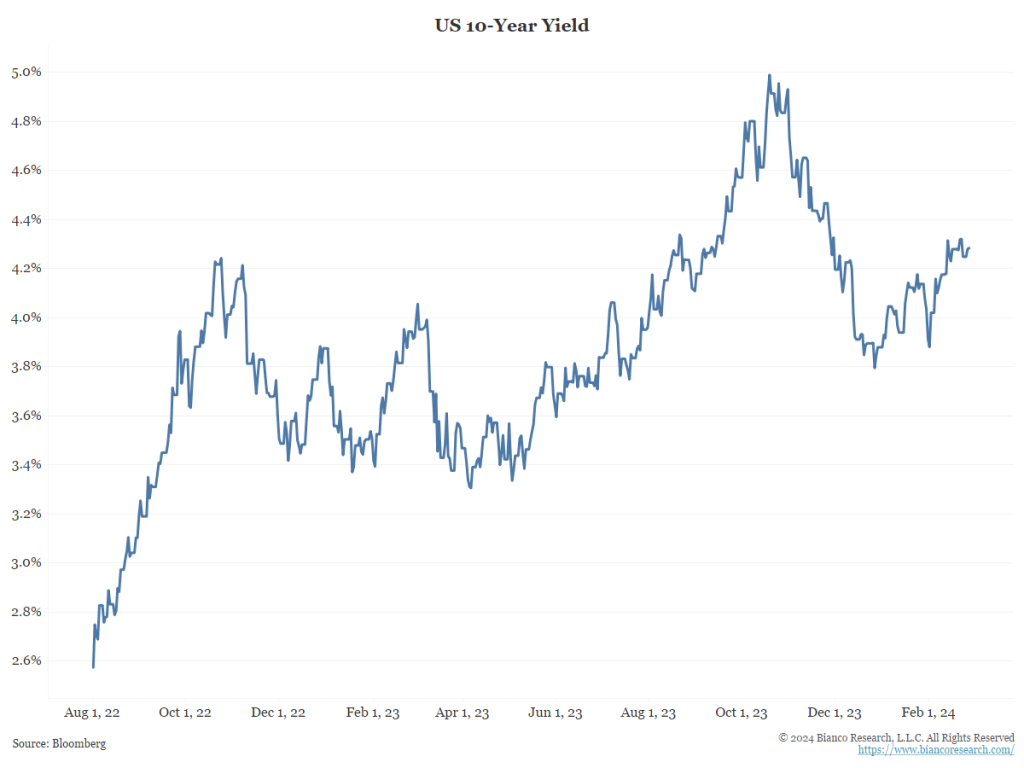

90% Duration

The index is underweight duration, based on the belief rates could head higher. The 10-year yield was recently at a 16-year high. While yields have fallen since October, we do not believe this trend is over.

Our outlook is a “no landing” economy, meaning it continues to expand at its potential or greater, and inflation remains “sticky.” Given this, the Index remains at 90% relative duration.

Year-to-date through Feb 23, our index has outperformed a broad-based investment-grade index by 43 basis points. Our duration positioning has accounted for 12 basis points.

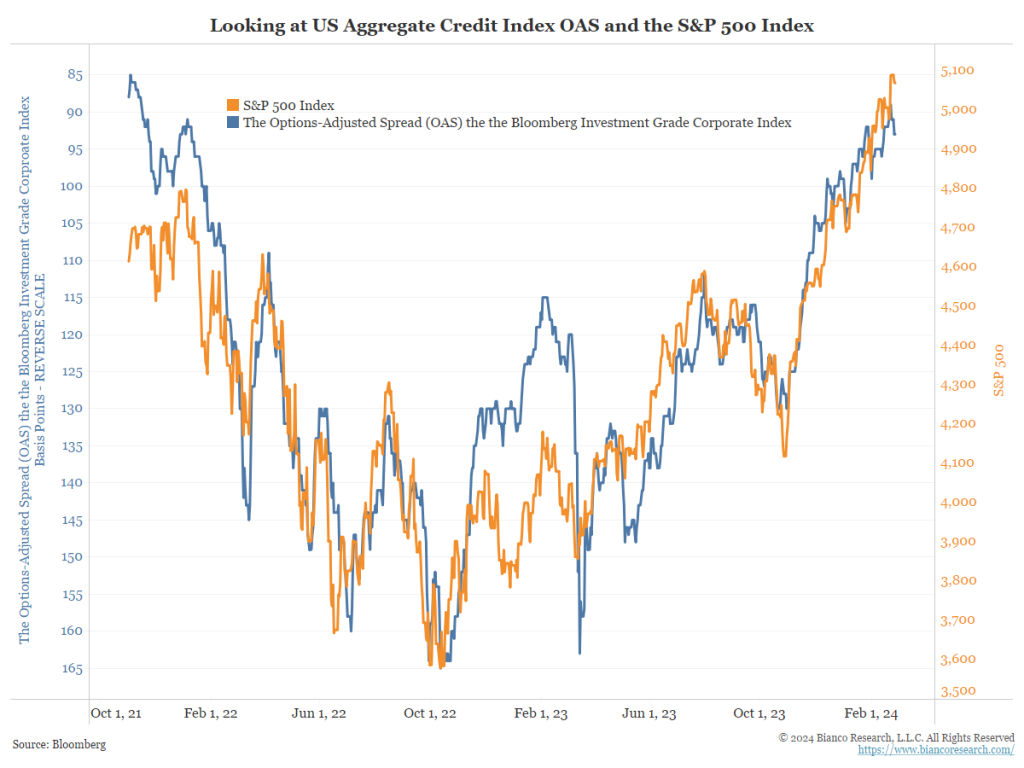

90% Underweight Credit

The Index moved to a 90% allocation to corporates relative to the benchmark in February. In other words, the Index holds an underweight allocation to corporate credit. It was previously 100% relative weighting.

The chart shows investment-grade corporate spreads (blue) and the S&P 500 (orange) move in tandem. Relative credit performance moves with equity prices. With stocks at all-time highs and record corporate bond issuance in 2024, the Index holds an unchanged 90% relative credit exposure.

Year-to-date through Feb 23, our index has outperformed a broad-based investment-grade index by 43 basis points. Our credit positioning has accounted for -4 basis points.

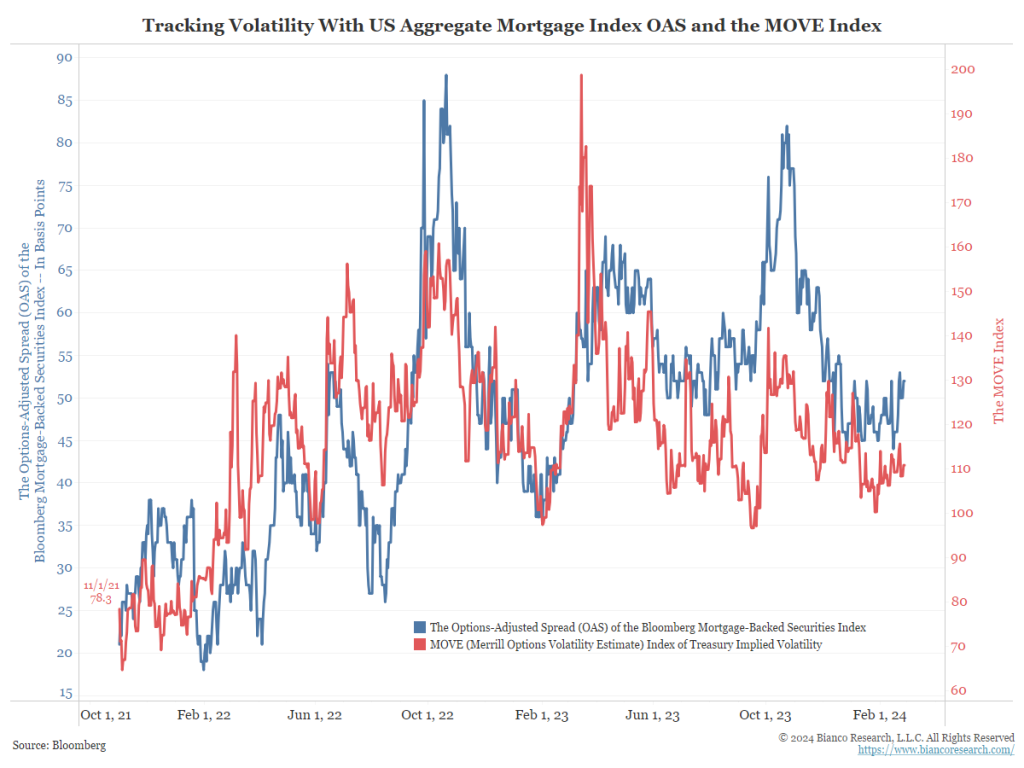

80% Underweight Securitized

All mortgages have an embedded option because holders can pre-pay their mortgage anytime. The option-adjusted spread (OAS) of mortgages (blue line) and the MOVE Index (red line), which measures the implied volatility of 30-day interest rate options, have a tight relationship.

Given the uncertainty surrounding inflation, Fed policy, and the belief that rates will move higher, look for the yield curve to bear steepen. While a steepening yield curve helps mortgages to outperform, a bear steeper should bring about continuous high levels of volatility. Given this, the Index holds an unchanged underweight position at 80% relative to the benchmark.

Year-to-date through Feb 23, our index has outperformed a broad-based investment-grade index by 43 basis points. Our mortgage positioning has accounted for +3 basis points

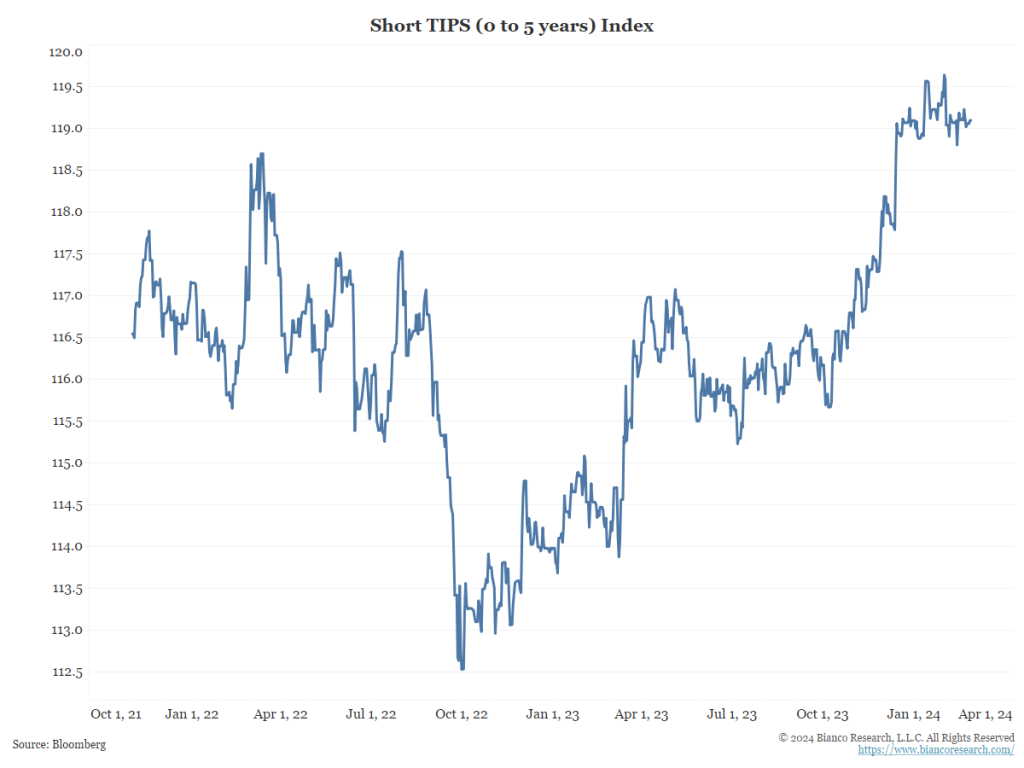

20% TIPS Conviction Allocation

The index owns short-maturity inflation securities (TIPS). The 2-year inflation break-even rate has widened from 200 bps in Q4 2023 to near 270 bps now.

We anticipate inflation break-evens holding these levels as inflation remains sticky. This will continue to provide attractive inflation protection with very little risk of price declines. The index holds an unchanged 20% allocation to 0-5 year Treasury Inflation Protected Securities (TIPS) as inflation protection.

Year-to-date through Feb 23, our index has outperformed a broad-based investment-grade index by 43 basis points. Our conviction position in short TIPS accounted for +32 basis points

Allocation Changes

| Name | March 2024 | February 2024 |

|---|---|---|

| iShares MBS ETF | 23.30 | 23.30 |

| iShares 0-5 Year TIPS Bond ETF | 20.00 | 20.00 |

| Vanguard Long-Term Corporate Bond ETF | 8.14 | 8.14 |

| WisdomTree Floating Rate Treasury ETF | 8.00 | 8.00 |

| Vanguard Short-Term Corporate Bond ETF | 7.24 | 7.24 |

| Schwab Long-Term U.S. Treasury ETF | 7.00 | 7.00 |

| Vanguard Intermediate-Term Corporate Bond ETF | 6.41 | 6.41 |

| Schwab Short-Term U.S. Treasury ETF | 5.91 | 5.91 |

| iShares 7-10 Year Treasury Bond ETF | 5.50 | 5.50 |

| iShares BBB Rated Corporate Bond ETF | 5.00 | 5.00 |

| iShares 3-7 Year Treasury Bond ETF | 3.50 | 3.50 |