The Index strategy is based on qualitative and quantitative inputs, including economic data and interpretations of government policy. Asset allocation guardrails include 50% – 200% allocation relative to the benchmark for credit, duration, and structure/mortgage weight. A high-conviction exposure to more speculative or diversifying positions is constrained to 0% – 20%.

The characteristics below reflect how we would best position a portfolio of fixed-income ETFs to achieve maximum total return over a comparable baseline neutral portfolio of fixed-income securities (benchmark).

Relative Positioning

Duration

90% Relative Underweight

Yield Curve

No Curve Position

Corporate Credit

Underweight

Securitized

Overweight

Conviction

5% EM Local Debt & 5% Short TIPS

Rationale

90% Duration

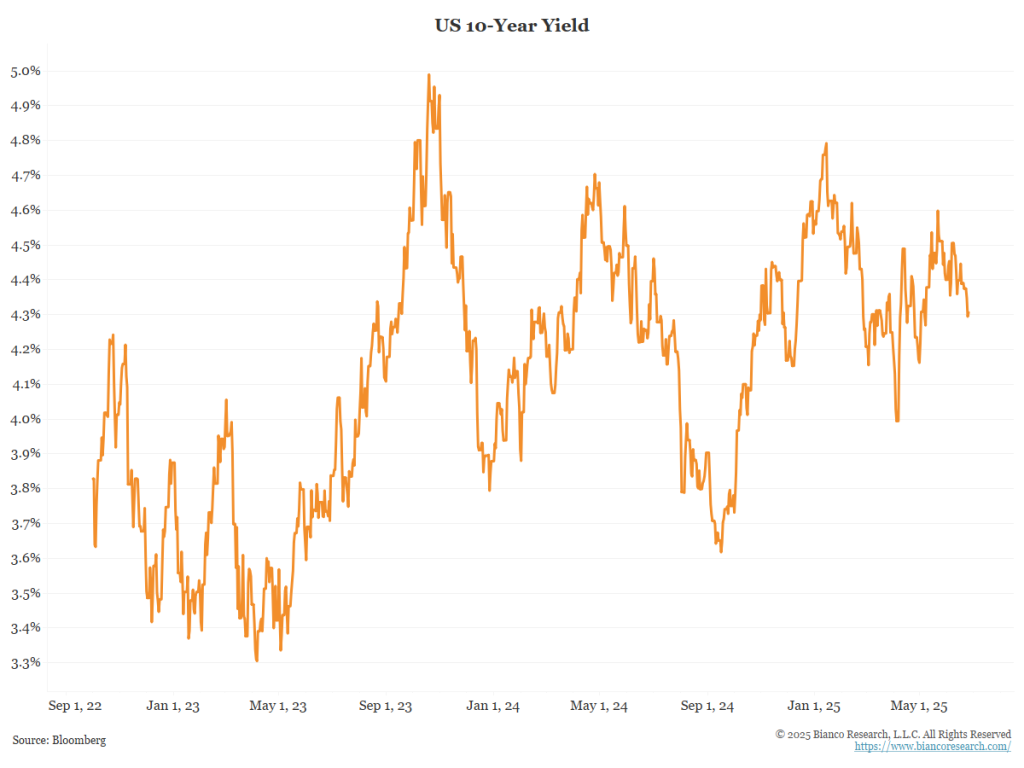

The Index holds 90% relative duration position compared to its benchmark, positioning for a rise in interest rates.

The committee expects the economy and inflation to remain stronger than expected. Recent talk of recession, tariffs, and 10% stock market corrections should have produced lower rates. Yet, the 10-year yield remains well above its low of 3.60% last September.

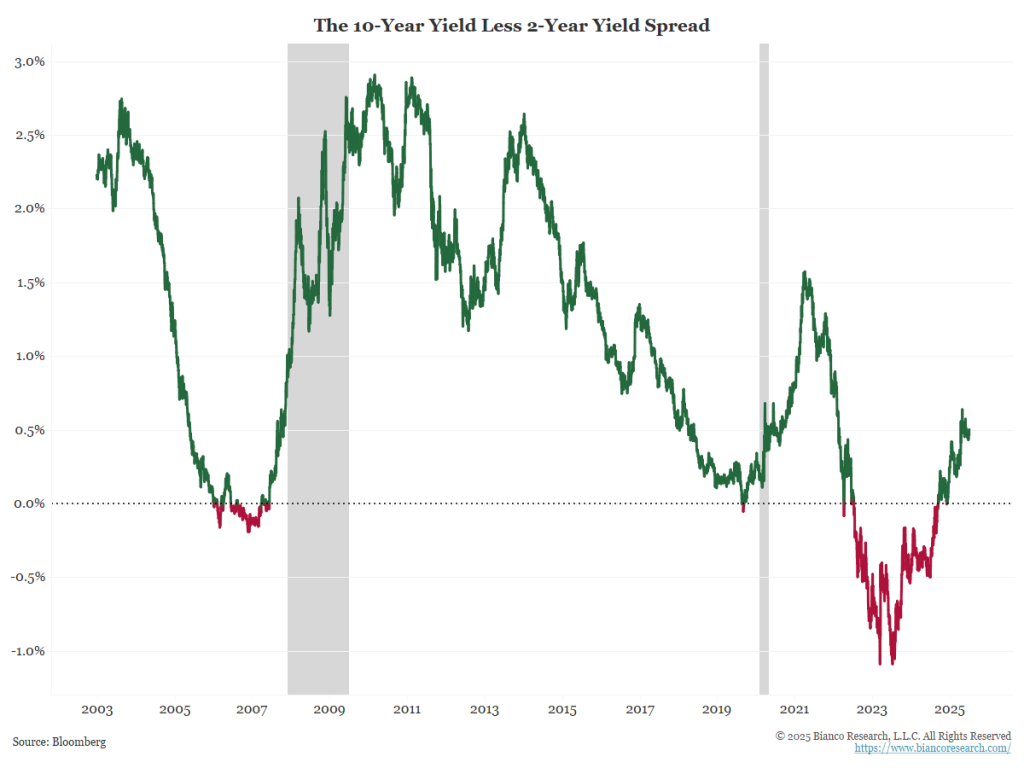

No Direct Curve Position

The Index shifted to a neutral curve strategy from a bulleted structure in June. While the curve has steepened through 2025, it has recently stalled.

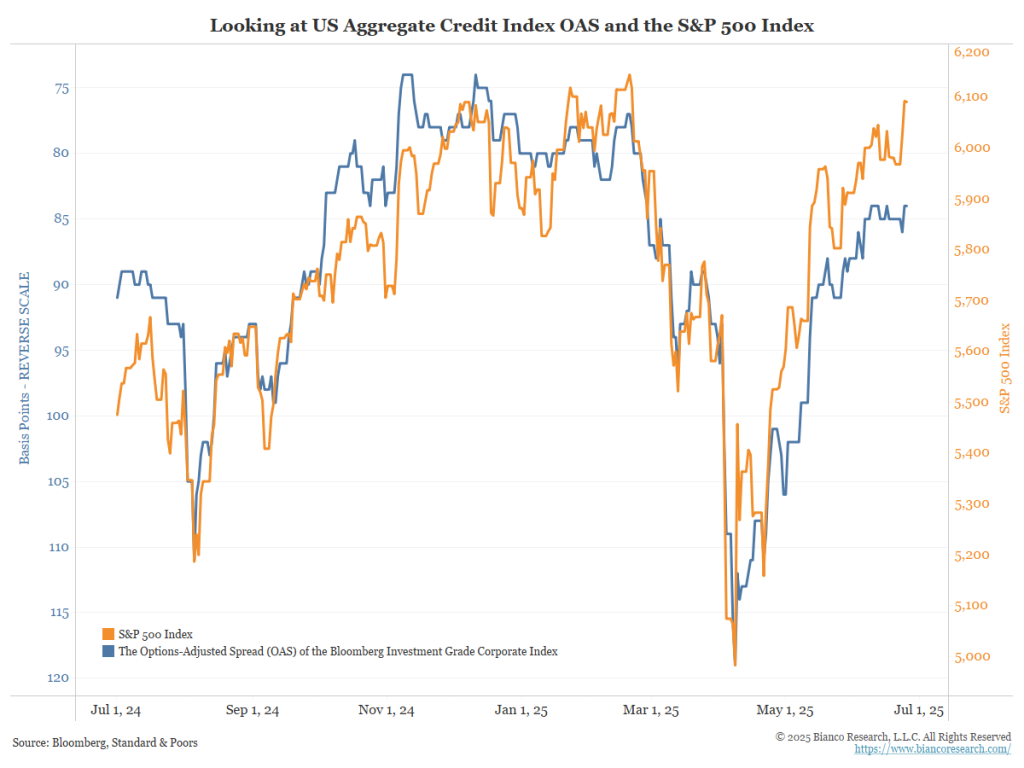

70% Underweight Credit

The Index is 70% weighted in corporate bonds relative to the benchmark, given strong corporate bond issuance (an increase in supply) and high valuations in the equity market.

Relative corporate bond positions are correlated to stock market movements.

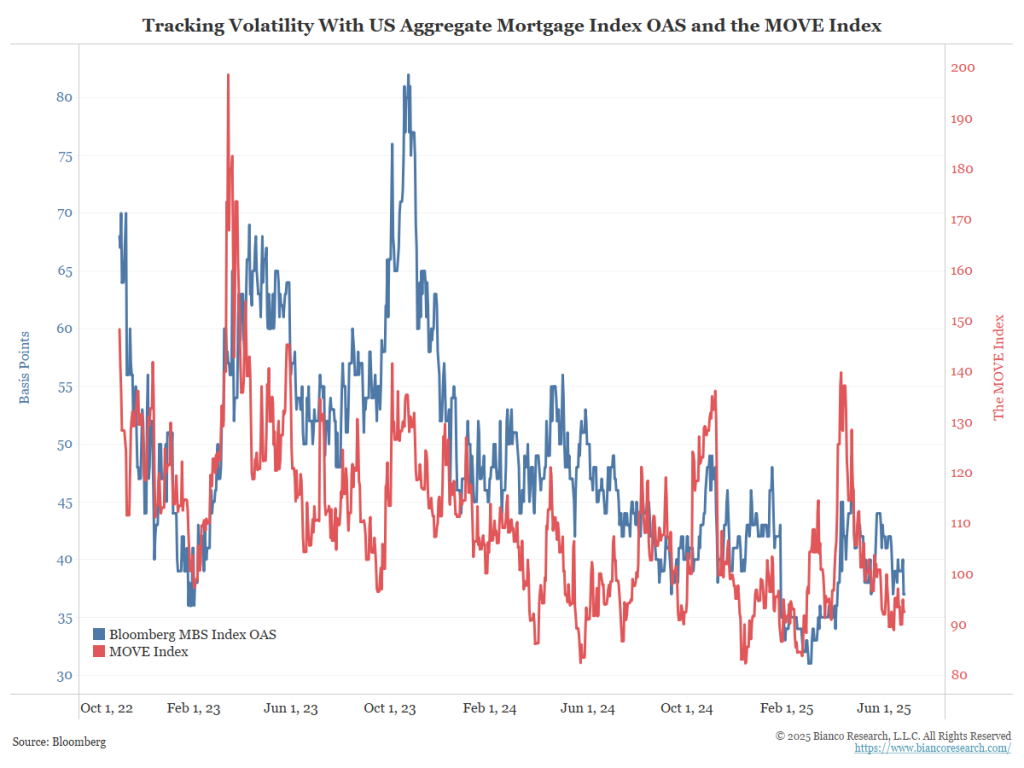

120% Overweight MBS

The committee decided to decrease the overweight in mortgage-backed securities (MBS) from 140% to 120% of the benchmark allocation in June. It continues to hold a 120% overweight position.

MBS yields are significantly higher than Treasury yields and comparable to those of investment-grade corporate bonds.

Rising Treasury yields will benefit MBS by slowing the rate of refinancing, keeping MBS yields high, and limiting any price declines.

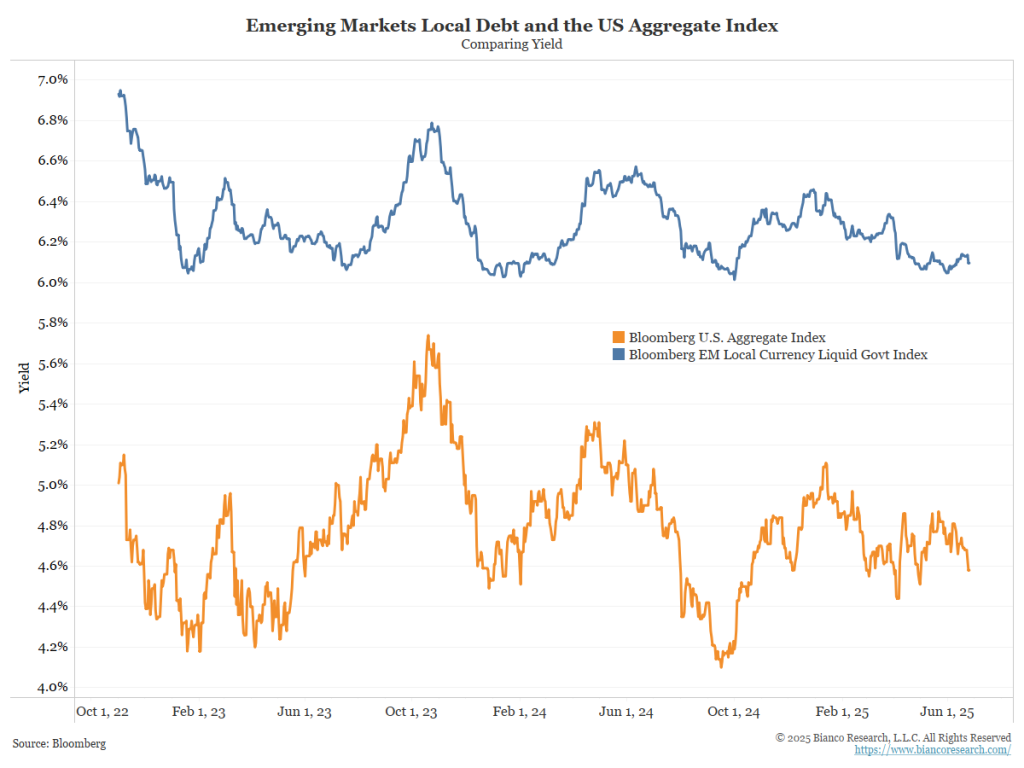

5% EM Local Debt & 5% Short TIPS

In July 2025, the committee decided to reduce the Index allocation to EM local debt from 10% to 5% while continuing to hold a 5% allocation to short (0-5) TIPS.

The EM Local Debt position offers a higher yield than domestic corporate bonds and has benefited from a weakening dollar relative to these currencies. The reduction in position was deemed appropriate.

The short TIPS position will offer inflation protection at an attractive yield.

Allocation Changes

| Name | June 2025 | May 2025 |

|---|---|---|

| iShares MBS ETF | 31.80 | 32.00 |

| Schwab Short-Term U.S. Treasury ETF | 18.60 | 5.00 |

| iShares 3-7 Year Treasury Bond ETF | 11.75 | 14.40 |

| Vanguard Short-Term Corporate Bond ETF | 8.20 | 9.70 |

| Schwab Long-Term U.S. Treasury ETF | 6.90 | 1.50 |

| WisdomTree Emerging Markets Local Debt Fund | 5.00 | 10.00 |

| iShares 0-5 Year TIPS Bond ETF | 5.00 | 5.00 |

| iShares BBB Rated Corporate Bond ETF | 4.50 | 4.50 |

| Vanguard Long-Term Corporate Bond ETF | 3.70 | 1.40 |

| Vanguard Intermediate-Term Corporate Bond ETF | 3.45 | 4.00 |

| iShares 7-10 Year Treasury Bond ETF | 1.10 | 12.50 |