Commentary

The government shutdown created a mess of economic data releases, clouding the picture of the Fed’s path ahead. We believe the labor market remains strong despite lower monthly payrolls because the breakeven rate has fallen as population growth slows. Inflation remains above the Fed’s 2% target. On rates, short-end yields have fallen with the funds rate, while long-end yields are staying elevated, indicating a steeper curve. Equities and corporate spreads have taken a hit as market participants parse data related to AI infrastructure overspend. Increasing rate volatility has created a tougher environment for MBS despite higher yields than Treasuries. Lastly, the dollar has begun making a comeback after nearly a year of poor performance.

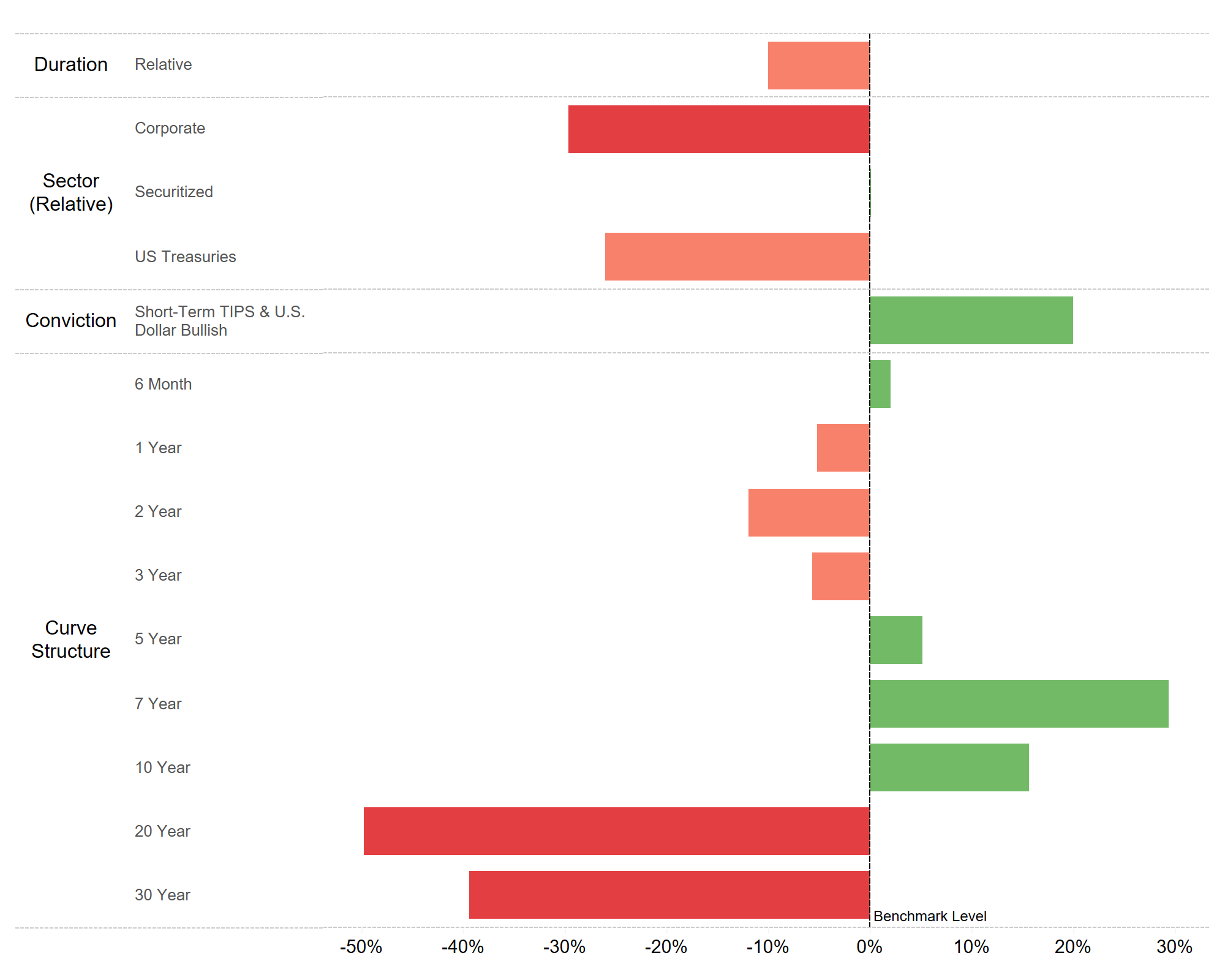

The characteristics, rationale, and deviations below reflect the index positioning relative to the baseline benchmark effective December 1, 2025.

Relative Positioning

Duration

Underweight

Yield Curve

Bulleted

Corporate Credit

Underweight

Securitized

Neutral

Conviction

Short-Term TIPS & US Dollar Bullish

Rationale

90% Duration

The committee expects the economy and inflation to remain stronger than expected. Despite Fed cuts, the 10-year yield remains above its September 2024 low of 3.60%. The duration of our index is 90% the duration of a benchmark index.

Bulleted Curve

We expect long-term yields to rise faster than short-term yields, thereby steepening the yield curve. The Index holds a bulleted curve position relative to the benchmark. This position would benefit from a steepening yield curve.

70% Underweight Credit

Relative corporate bond positions are correlated to stock market movements. Equities have been weakening while credit spreads have widened. An underweight position benefits from a weakening equity market.

Neutral Securitized

The index holds a neutral position relative to the benchmark within the securitized sector. Increasing volatility makes owning MBS less attractive.

10% Short-Term TIPS

A short-term TIPS position offers inflation protection at an attractive yield. Breakeven inflation rates have narrowed, making this an attractive position.

10% US Dollar Bullish

After a year of trending lower, the dollar is making a comeback, making a bullish dollar play attractive. So, this month, we are initiating a 10% long position in the Bloomberg Dollar Index.

Deviations

Allocation

| Name | Market Value (%) |

|---|---|

| iShares MBS ETF | 26.60 |

| iShares 3-7 Year Treasury Bond ETF | 16.50 |

| iShares 7-10 Year Treasury Bond ETF | 11.50 |

| iShares 0-5 Year TIPS Bond ETF | 10.00 |

| WisdomTree BBG USD Bullish Fund | 10.00 |

| Vanguard Intermediate-Term Corporate Bond ETF | 8.25 |

| Schwab Long-Term U.S. Treasury ETF | 4.80 |

| Vanguard Long-Term Corporate Bond ETF | 4.20 |

| iShares BBB Rated Corporate Bond ETF | 4.00 |

| Vanguard Short-Term Corporate Bond ETF | 3.00 |

| Schwab Short-Term U.S. Treasury ETF | 1.15 |